Di tendenza

ULTIMI ARTICOLI

La tecnologia vi ha stufato? Boring Phone vuole riportarvi al passato

Se vi dicessi che un'azienda come Heineken, finora nota esclusivamente per la sua birra, si è cimentata nel creare un telefono? E non un telefono qualsiasi: annunciato alla Milano Design Week, The Boring Phone...

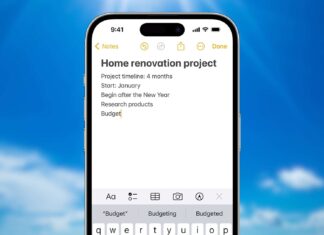

iOS 18: Apple pensa ad un rinnovamento completo per l’app Note

Mancano poco più di 2 mesi alla presentazione ufficiale di iOS 18, ma in rete continuano ad emergere nuovi dettagli su quelle che potrebbero essere le novità del sistema operativo mobile di iPhone. Secondo...

One UI 7: Samsung darà agli utenti una feature molto richiesta

La One UI 6.0 è arrivata assieme al rilascio di Android 14, in questi mesi sta avvenendo il rilascio della One UI 6.1 ma stiamo già iniziando a conoscere le primissime novità di Samsung...

Redmi Pad Pro: il maxi tablet economico sarà anche Global

Di recente Xiaomi ha presentato due nuove aggiunte al lineup di Redmi, ossia il primo smartphone dell'inedita serie Turbo e un tablet di dimensioni maggiori rispetto ai precedenti. A distanza di pochissimo ecco spuntare...

Twitter/X diventa a pagamento (o quasi): svelati i possibili prezzi anti-bot

Aggiornamento 17/04: in rete è emerso un vecchio di tweet di Elon Musk dove parla del possibile nuovo abbonamento per i neo iscritti a Twitter/X, suggerendo quello che potrebbe essere il prezzo annuale da...

Il primo flip phone OnePlus avrà una fotocamera più avanzata del solito

OnePlus Open ha segnato il debutto di OnePlus nel settore degli smartphone pieghevoli, ma nel suo catalogo è al momento assente un modello di flip phone. Mentre compagnie come Samsung, Huawei e le stesse...

Lenovo Yoga Slim 7 sarà tra i primi con Snapdragon X Elite: eccolo nelle...

I primi laptop con l'inedito Snapdragon X Elite si avvicinano sempre più ed in queste ore sono emerse in rete le prime immagini di quello che potrebbe essere uno dei primi modelli ad arrivare...

Recensione Geekom Mini IT13: il più potente tra i Mini-PC Windows

Arriviamo probabilmente con un po' di ritardo rispetto la data di uscita sul mercato cinese di questo modello, ma considerata la scheda tecnica faraonica a disposizione, diciamo che l'attesa questa volta è ben ricompenssata....

Samsung HP9: il nuovo 200 MP esordirà sul camera phone di un altro brand

A parte Sony, Samsung è l'unica azienda che ha le competenze tecniche per prodursi un componente hardware quale il sensore fotografico, che negli anni abbiamo conosciuto grazie alla sua divisione ISOCELL. Da qualche anno,...

Roidmi EVA torna in sconto: è il migliore a questo prezzo (con dock autopulente)!

Tra i tanti robot vacuum cleaner visti, c'è sempre una distanza tra i modelli di fascia più accessibile, ma con qualcosa in meno, e ovviamente quelli top gamma che però sono spesso troppo costosi....